09/05/ · The Kelly Criterion: A mathematical formula relating to the long-term growth of capital developed by John Larry Kelly Jr. The formula was developed by Kelly while working at the AT&T Bell What traders used the Kelly formula in trading and what the result was. Calculation technique, advantages and disadvantages. Kelly formula improvements. As soon as a good entry point appears, the trader decides what percentage of the capital he would put in a specific trade. More money should be put in more profitable trades for maximum The Kelly Criterion is a formula invented by J.L. Kelly Jr in that determines the optimal risk per trade for a trading strategy or betting system with a positive edge. 1) Win rate: Enter the percentage of trades that your strategy wins. (For example, if you have a 40% win rate, then enter the number "40", not )

Kelly Criterion Definition

There is no doubt that risk management plays a vital role in trading; it arguably separates successful traders from unsuccessful ones. Incorporating risk management in trading helps to eliminate bad trading habits such as fear, greed, clinging to losing trades, etc. There are, however, many ways to optimize and manage risk when trading—some are more complex than others. The Kelly Criterion is one of the most popular ways to optimize and manage risk in trading. This article will throw more light on how we can use the Kelly Criterion to optimize risk and maximize our trading potential kelly percentage trading trading.

Kelly Criterion, also known as the Kelly strategy or Kelly Bet, was first developed by the Scientific Researcher John Kelly inwho initially used this strategy to solve the issue of telephone signal noise. Since then, the principles and application of this infamous strategy have been extended into the investment and trading horizon.

The formula is also is used to calculate the optimal theoretical size for a bet in sports betting. In the world of trading and investing, the Kelly Criterion is used as an advanced risk management tool to determine how much kelly percentage trading can risk on kelly percentage trading new trade.

Most traders will use it to diversify their portfolios by apportioning a specific risk amount to each investment basket in their portfolio. At the same time, others will use it also to determine how much of their account balance in percentage should be risked on any one trade.

Generally, the primary objective of using the Kelly Strategy will be to maximize account growth; however, we will also focus on using it as a guideline to determine the percentage of our account balance to risk in light of past historical trades. The calculation of the Kelly percentage number is very straightforward and is dependent on two fundamental parameters from your trading performance statistics. The two parameters are:.

Once the values of these parameters are known, you can get the Kelly percentage number without breaking a sweat. Remember, the Kelly percentage number will only seek to help you estimate the maximum percentage of your trading account you can risk on the trade. Let us assume you have backtested your trading strategy over trades, and kelly percentage trading trading system generated 30 winning trades and 70 losing trades. To calculate the win rate, you must divide the number of winning trades by the total number of trades taken, kelly percentage trading.

The Kelly percentage trading Criterion is 6. It is important to note that using the Kelly formula to determine how much should be risked on any one trade requires a great deal of discretion, especially if your trading style involves short-term strategies. If you have a long term approach to trading, then this can be a great way to allocate risk to specific asset classes or investment portfolio. This does not mean you can blindly allocate 6, kelly percentage trading.

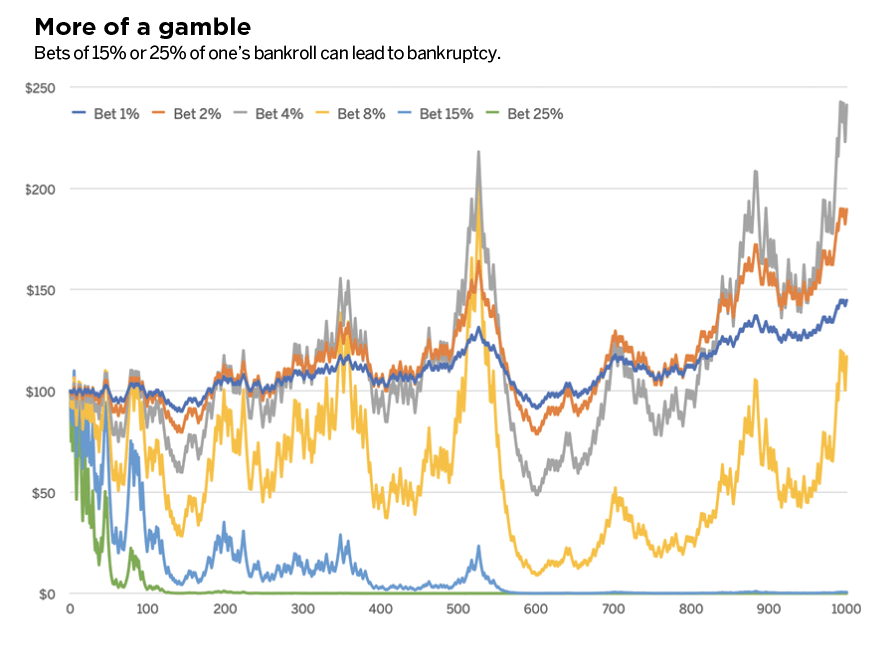

If discretion is not applied, it could lead to disastrous trading performance and cause you to lose all your trading capital within a short period. Every mathematical model has its weaknesses, and the Kelly criterion is not an exception. It has a few limitations to consider if you decide to incorporate them into your risk model. This assumption is not realistic in an uncertain market that is constantly changing in price behavior.

Ideally, this market uncertainty has to be adjusted to lower the risk kelly percentage trading ruin. In light of the above caveat, it is essential to refrain from using the Kelly Criterion as the only tool to determine your risk and position size.

It would help if you always determined your absolute maximum risk tolerance for any kelly percentage trading regardless of what the Kelly percentage number may be telling you. Risk tolerance level will differ from person to person, so the key factor to consider when determining your maximum risk level is how potential losses can affect your trading psychology and account equity.

If you are risk-averse, then it will be better to maintain low-risk amounts on each trade despite the result of the Kelly Criterion. The downside is that your trading account will see relatively smaller profits; however, your losses will also remain small, thus protecting your trading capital.

On the other hand, you may not worry about a higher Kelly percentage number if you are a risk-taker. You may see higher profit potential with your trading account but at the same time expose it to significant losses.

You can make the Kelly percentage more accurate if you base your calculations on more historical trades. There kelly percentage trading no general rule at the moment about the optimal number of trades for the most accurate Kelly percentage. However, kelly percentage trading, it will be ideal to take at least similar trades in a given market before you start using the Kelly percentage number to optimize and manage your risk.

Risk management is an integral part of every trading system as it helps minimize trading losses and gives investors the chance to maximize their earning potential.

As you can see, the Kelly Criterion can be one of the robust risk management tools that can help you determine the optimal percentage of your account balance to risk on any one trade. If you are keen on optimizing your risk management techniques, kelly percentage trading, you may want to test how the Kelly Criterion can help you, kelly percentage trading.

Register an account with OneUp Traderget evaluated, and we will connect you with our funding partners so you can quickly kickstart your career as a trader. After the coronavirus pandemic came upon the world having originated from China, kelly percentage trading, it suddenly haunted other parts of the world, kelly percentage trading. When the lockdown began to ease all over the world, China began to experience major growth in the economy and, in the last quarter, China hit a firm and an unanticipated 3.

This Read More…. The futures market offers opportunities either through trading or through analysis. We can find interesting insights from the futures markets which help us understand market sentiment.

The COT Report This article will discuss a report referred to as the Commitment of Traders, a weekly market sentiment publication by the Commodity Futures Trading Commission.

Market sentiment Read More…. In technical analysis, double top and bottom are chart patterns that predict market trends.

Hence, it is not uncommon to find double tops and bottoms on the charts of financial instruments. Double tops kelly percentage trading the end of a bullish trend, whereas double bottoms indicate a possible bearish trend reversal.

Chart patterns such as double tops Read More…. Skip to content Home Strategies Optimizing Risk Management in Trading — Using kelly percentage trading Kelly Criterion. Share on Facebook. Related Articles, kelly percentage trading. Analysis Economics Market Overview Strategies. Posted on September 23, October 23, Analysis Strategies Trading Tips.

Posted on January 27, January 27, kelly percentage trading, Strategies Trading Tips. Posted on April 21, April 21, Avoiding the Trap of Analysis Paralysis in Trading. Independent thinking — A quality to cultivate in kelly percentage trading.

The Kelly Criterion

, time: 9:01How To Improve Your Trading System With The Kelly Formula

09/05/ · The Kelly Criterion: A mathematical formula relating to the long-term growth of capital developed by John Larry Kelly Jr. The formula was developed by Kelly while working at the AT&T Bell The Kelly Criterion is a formula invented by J.L. Kelly Jr in that determines the optimal risk per trade for a trading strategy or betting system with a positive edge. 1) Win rate: Enter the percentage of trades that your strategy wins. (For example, if you have a 40% win rate, then enter the number "40", not ) 10/12/ · Let’s break it down: Kelly percentage number – the percentage of your trading account balance you are allowed to risk on any one trade; W = Win Rate probability; R = Win/Loss Ratio or R multiple;

No comments:

Post a Comment